.png)

Accounting firms today are juggling more clients, more compliance, and tighter deadlines—manual tracking simply won’t cut it. That’s why leveraging the right tech stack is now a baseline for efficiency. But here’s the catch: many firms confuse CRMs with practice management tools. The fix? Know their roles. Use a CRM to track client touchpoints, lead pipelines, and proposals. Use practice management software to manage deadlines, delegate work, and automate recurring tasks. This article will help you nail the distinction, so you’ll be able to eliminate double-handling and recover hours every week.

A CRM (Customer Relationship Management) system is designed to help you manage and convert prospective leads—think new inquiries, referrals, and prospects from marketing campaigns. While it can technically store existing client data, most CRMs are not well-suited for ongoing client collaboration or service delivery in the accounting and bookkeeping profession. That’s a job better handled by a practice management system.

In an accounting firm, a CRM shines during the pre-engagement phase. It helps you organize and follow up on every lead so no opportunity slips through the cracks.

Use Case: Let’s say you launch a Facebook ad campaign offering tax prep consults. A CRM helps you capture those leads, move them through your funnel, and convert them into clients. But once they’re onboarded? That’s when you hand them off to your practice management system—where real collaboration, deliverables, and workflows begin.

Think of practice management software as your internal command center. Unlike a CRM, which focuses on prospect relationships and lead nurturing, this tool is all about getting the actual work done. For accounting and bookkeeping firms, this means keeping track of client communication, deliverables, recurring tasks, & team responsibilities—all in one place.

If you’ve ever lost time chasing deadlines, reassigning tasks in chat threads, or manually updating a work tracking spreadsheet, this is the fix.

Use Case: Say you’ve got 80 clients on monthly bookkeeping. Instead of manually setting reminders, a practice management tool auto-generates those jobs, assigns them to the right staff, and tracks completion. When someone’s out sick? You can easily reassign the task with full visibility into what's been done—and what’s still pending. Pretty neat!

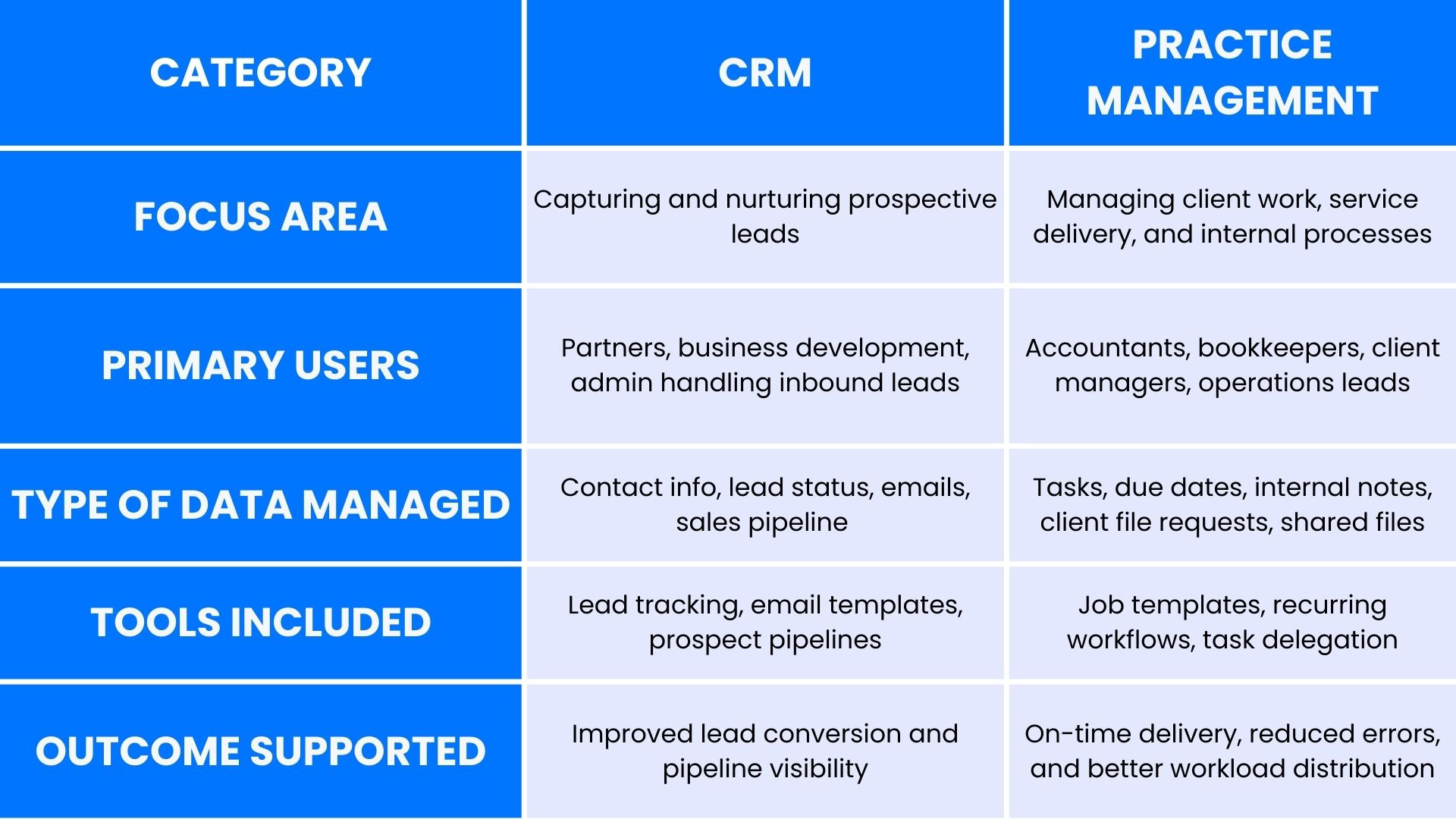

Still unsure which tool does what? Here’s a side-by-side breakdown to help you draw the line. Understanding these distinctions can help you choose the right system for the right job—and avoid bloated software costs or process overlaps.

How to Apply This in Practice: If you’re actively generating leads or offering new services, a CRM will help you track and convert those inquiries. But once a client signs the engagement letter, shift them to a platform like Client Hub—where tasks, communication, and collaboration can happen seamlessly in one place.

Do you really need two separate tools to manage your firm? Not always. For accounting and bookkeeping practices trying to scale without the overwhelm, all-in-one platforms are becoming a game-changer. These hybrid tools combine CRM and practice management functionality—helping you streamline both client-facing and internal workflows in one place.

Why this matters for your firm: Switching between five different tools to check on client emails, assign tasks, and track deadlines burns time and creates gaps. A unified platform means less context-switching, fewer dropped balls, and clearer team accountability.

Client Hub was built specifically for accounting firms that want to reduce friction in both service delivery and client communication. It bridges the gap between managing the work and collaborating with the client—something most CRMs don’t do well. While a CRM typically focuses on leads and prospect tracking, client collaboration should live inside your practice management system—and that’s exactly where Client Hub shines.

Use Case: Let’s say you’re onboarding five new clients during tax season. Instead of manually sending each one a welcome email, document checklist, and task tracker, Client Hub automates the sequence—and your team can monitor who’s completed what, without ever leaving the platform!

To recap: CRMs are built to manage prospective leads—tracking inquiries, proposals, and pipeline stages. But when it comes to collaborating with existing clients, they fall short. That’s where practice management systems take over—keeping your internal team aligned on deliverables, deadlines, and ongoing client communication.

If you’re looking for a solution that handles both sides in one place, Client Hub gives you smart workflows, built-in client portals, and automation designed specifically for accounting pros. Check it out today!